Homebuyer Information Session

3030 Poplar Ave

Memphis, TN 38111

3030 Poplar Ave

Memphis, TN 38111

Since 1983, Habitat for Humanity of Greater Memphis has partnered with over 600 homebuyers to provide the guidance, education and support they need to achieve their dream of owning a safe, affordable home. As the only organization in the 901 offering zero-interest mortgages, we make owning a home cheaper than renting. Additionally, our extensive financial education program equips homebuyers with the tools they need to succeed. We encourage all interested and qualified individuals to attend an information session about our homebuying program – it’s the first step toward buying a home.

Memphis Habitat builds affordable, energy-efficient homes to last—constructed to Memphis Light, Gas & Water’s EcoBUILD standards for sustainability and long-term value. Each single-family home features 3 to 5 bedrooms, energy-efficient appliances, and durable materials throughout.

You'll find personalized exteriors with color and basic landscaping, plus open living areas, modern kitchens, and central heating and air to keep your family comfortable year-round.

Closing on your Habitat home is a life-changing milestone, but it’s just the start of your journey. By making your affordable monthly mortgage payments on time, you’re not only building long-term stability for your family—you’re also helping Habitat continue its mission of creating safe, affordable housing for more families across Memphis. Each monthly payment you make is an investment in your future.

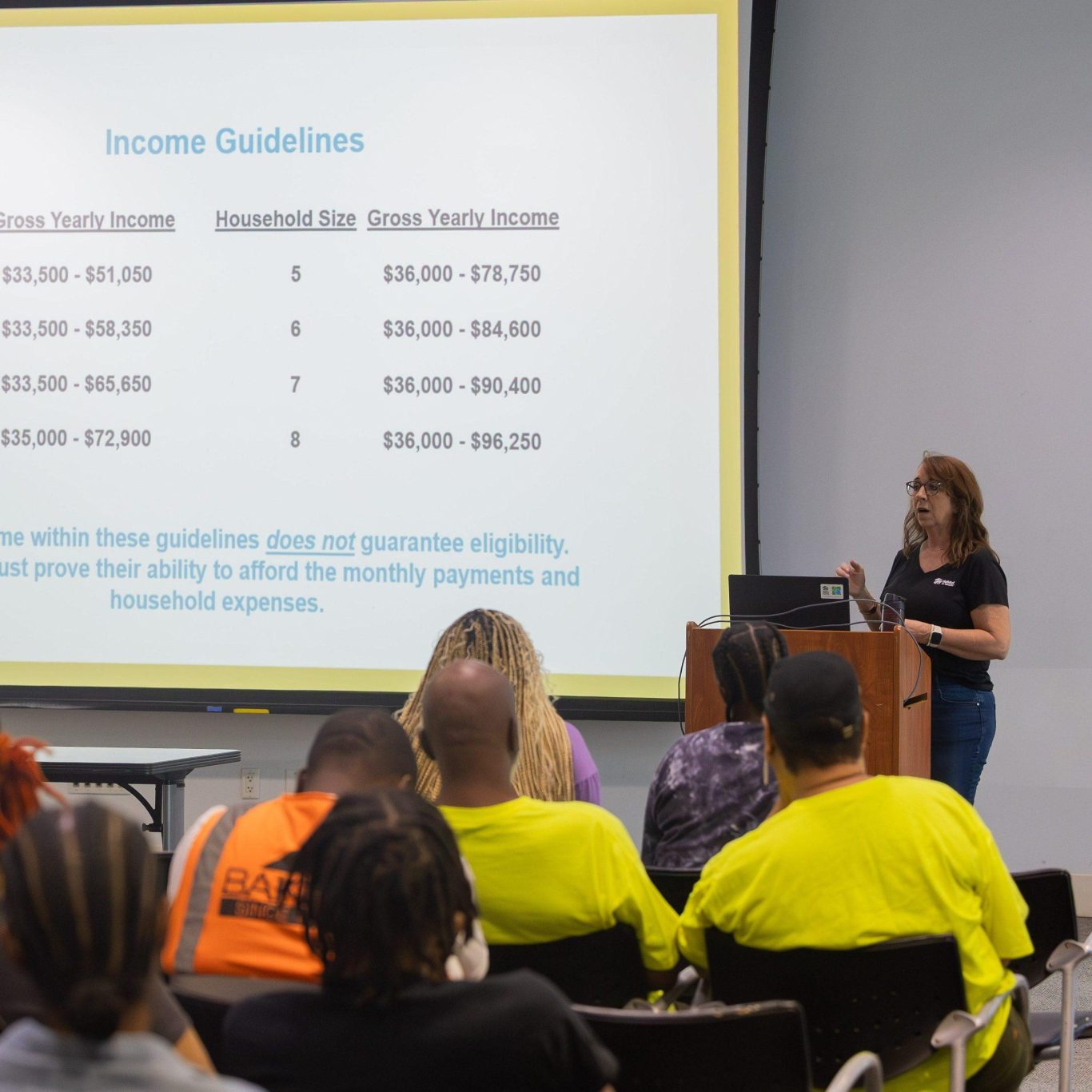

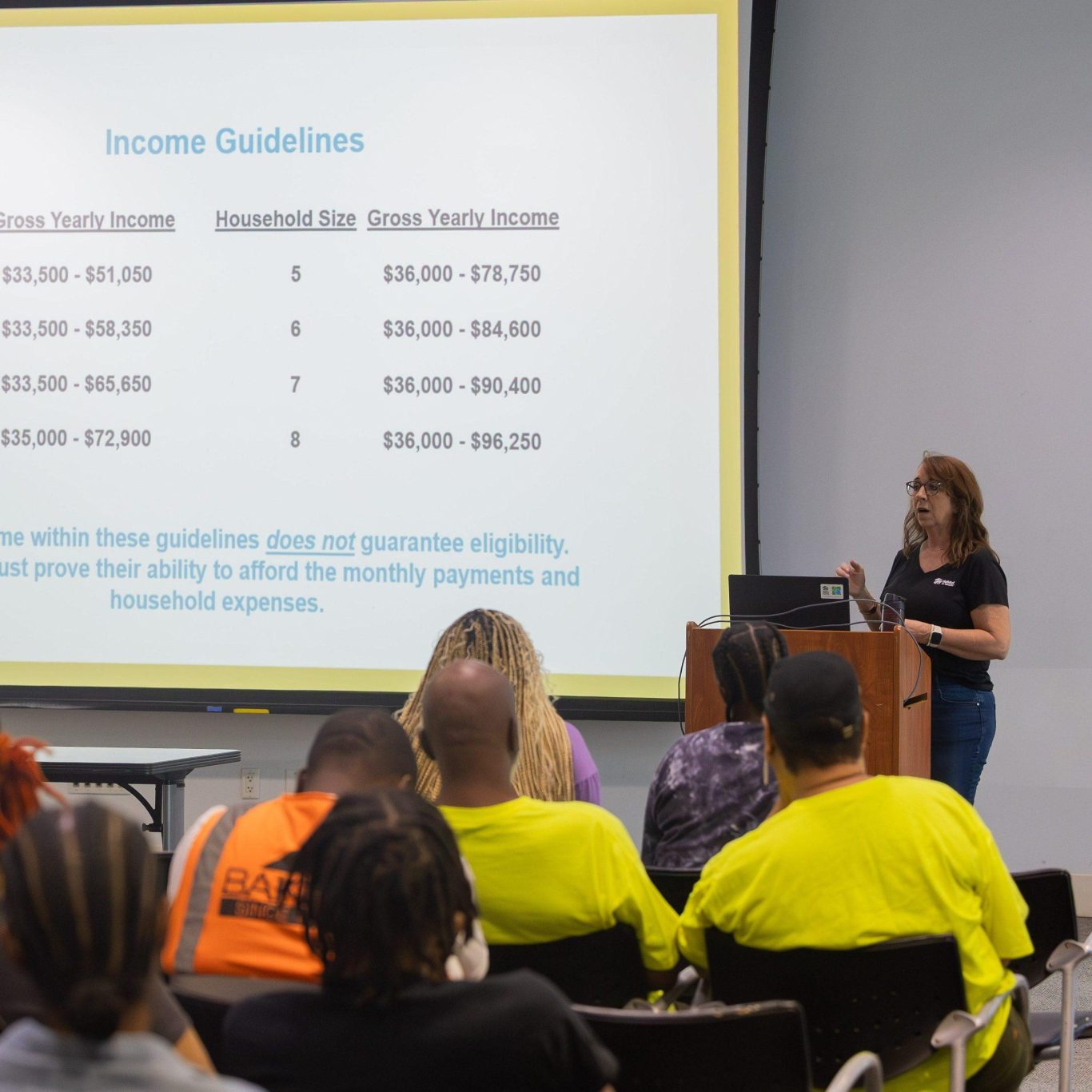

Memphis Habitat homes are sold at fair market value based on appraisal, and buyers receive a zero-interest mortgage, making monthly payments more affordable. Homebuyers are also required to contribute $2,000 toward closing costs and save for an emergency fund.

Yes! Memphis Habitat homebuyers will contribute at least $2,000 toward closing costs.

Memphis Habitat works hard to match families with homes that meet their needs. However, choices may be limited based on funding, availability, and construction timelines. Habitat for Humanity builds throughout Shelby County and, at times, in Fayette County.

Yes! If you need translation services, please email newhomes@memphishabitat.com or call 901-322-3519 to schedule a one-on-one session with a qualified translator.

Homebuyers must complete education classes, volunteer hours, attend financial coaching sessions, save for an emergency fund, contribute to closing costs, and meet other qualification benchmarks before closing on their home. After closing, they are responsible for repaying a 30-year, interest-free mortgage.

Please email newhomes@memphishabitat.com if you have any questions about our Homebuying Program.